Executive Summary

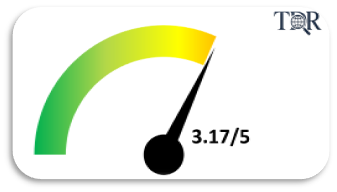

The terrorist attack linked to Pakistan has significantly heightened tensions between India and Pakistan. On the TDR Meter, the event scores 3.17 out of 5, reflecting a medium-to-high intensity risk with strong escalation potential. In a world already grappling with two ongoing wars and a major trade conflict, India-Pakistan development further strains global stability.

Introduction

On April 22nd, a terrorist attack in Pahalgam, Kashmir, claimed the lives of 27 innocent civilians. Reports indicate that the perpetrators had links to Pakistan, with the attack seemingly aimed at destabilizing Kashmir’s trajectory towards an economic powerhouse. This incident has further strained the already fragile relations between India and Pakistan. In this post, we analyse the geopolitical impact of India-Pakistan tensions across three dimensions – financial markets, escalation risk, and long-term implications for businesses.

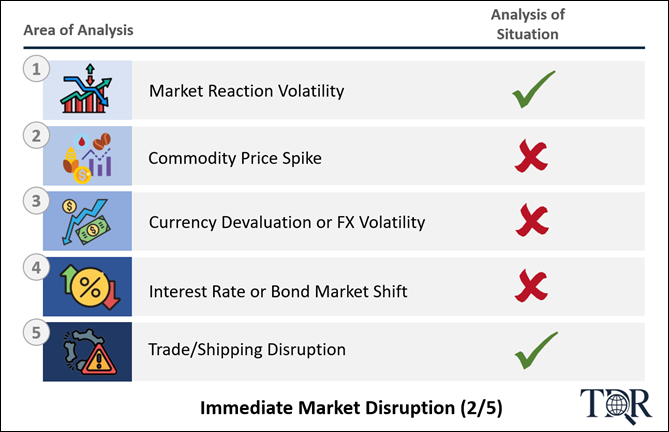

1. Immediate Market Disruption

Despite rising India-Pakistan tensions, markets have shown a limited reaction. With global attention already divided between two active wars and a US-China trade standoff, investor sensitivity to regional conflicts appears diminished.

- Market Reaction

- The SENSEX remained relatively stable, indicating limited investor panic or reallocation of capital in response to rising geopolitical tensions.

- In contrast, Pakistan’s KSE-100 Index dropped by 6% in the week following the April 22nd attack, reflecting greater market sensitivity and perceived economic vulnerability.

- Commodity Price Spike

- There has been no significant movement in global commodity prices such as oil, gas, or gold.

- As neither India nor Pakistan is a major producer or exporter of these commodities, global supply chains remain unaffected.

- Currency Devaluation or FX Volatility

- The Indian Rupee (INR) and Pakistani Rupee (PKR) have shown minimal volatility.

- Stable FX markets suggest that investors are not expecting an immediate escalation with macroeconomic consequences.

- Interest Rate or Bond Market Shift

- No noticeable shift in bond yields or central bank behaviour has occurred.

- However, if tensions escalate, a flight to safety could push investors toward bonds and drive bond prices up (yields down), especially in India, as investors seek lower-risk assets.

- Trade/Shipping Disruption

- Bilateral trade has been suspended, with Pakistan bearing the larger impact, particularly in pharmaceuticals, which rely heavily on imports from India.

- Both countries have also halted air traffic for each other’s airlines, affecting airline revenues and operations.

Summary

While tensions are serious, market reaction has been contained for now, particularly in India. The situation is being monitored closely, but no broad-based panic has yet materialized across asset classes. Hence, a score of 2 out of 5.

2. Escalation Risk

The risk of escalation is significant, with continuous troop movements, cross-border firing, and heightened rhetoric from both sides. Global actors — including the UNSC — have called for restraint, particularly urging India to de-escalate. However, with uncertainty around how far this conflict could spiral, the region remains on edge, and the potential for broader consequences cannot be ruled out.

- Military Build-up or Conflict

- Troop movements have commenced on both sides, involving the Indian Army, Navy, and Air Force, indicating a high-level mobilization.Continuous shelling along the Line of Control (LoC) has escalated the situation beyond sporadic clashes.

- The possibility of a limited strike or full-scale war is now a real and growing risk, especially given the operational freedom granted to Indian forces.

- Diplomatic Fallout: Embassies closing, sanctions, withdrawal from alliances

- Diplomatic ties have severely deteriorated:

- Embassies have been closed

- Visa services suspended

- Both nations are actively seeking international support to rally pressure on each other, signifying a hardened stance in foreign policy.

- Diplomatic ties have severely deteriorated:

- Policy Retaliation Risk Counter-sanctions, asset freezes, import bans

- Long-standing treaties such as the Indus Waters Treaty and the Shimla Agreement have either been suspended or rendered ineffective. Trade and airspace restrictions are already in place.

- India is reportedly considering a ban on Pakistani ships docking at its ports, further intensifying the economic and diplomatic isolation.

- Leadership Involvement: Head of state or PM involved

- Top political and defence leadership on both sides—Prime Ministers, Foreign Ministers, Defence Ministers, and Army Chiefs—are involved and issuing firm, retaliatory statements.

- This high-level engagement underscores the seriousness and urgency of the crisis.

- Global Power Involvement

- While direct involvement by global powers (U.S., China, Russia) is unlikely at this stage due to ongoing global crises (Ukraine, Middle East, U.S.-China trade tensions), diplomatic interventions are likely if the conflict escalates.

- Any full-blown conflict would draw significant international pressure and potentially third-party mediation or sanctions.

Summary:

The situation is on the brink of significant escalation. The combination of troop movements, suspended treaties, diplomatic breakdown, and vocal leadership engagement suggests that tensions are at their highest since 2019 or even 2001. A near-war posture now exists, justifying a score of 4.5 out of 5 for escalation risk.

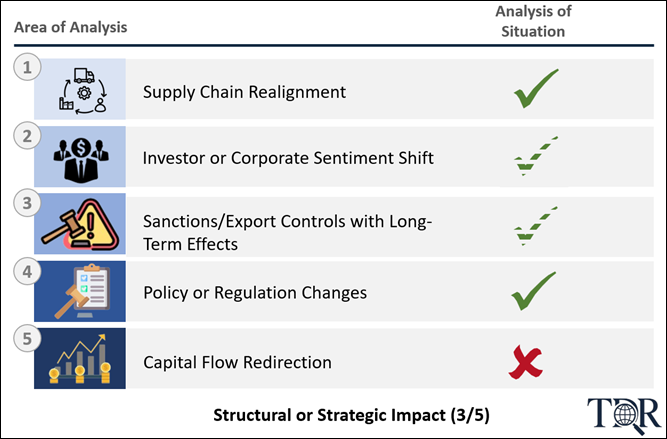

3. Structural or Strategic Impact on Businesses

The current tensions between India and Pakistan are not yet triggering a full strategic overhaul, but certain long-term shifts are already underway or could materialize if the conflict persists.

- Supply Chain Realignment

- Cross-border logistics are facing new challenges:

- For instance, Afghan dry fruits routed via Pakistan are now blocked, forcing India to explore alternate trade corridors (e.g., via Iran or Central Asia).

- Airspace closures increase costs and time for international freight and passenger flights.

- Potential naval access restrictions may impact maritime trade.

- Over time, businesses are likely to realign their logistics and supply chain dependencies away from conflict-sensitive routes.

- Cross-border logistics are facing new challenges:

- Investor or Corporate Sentiment Shift

- Investment risk perception may rise, particularly in border regions like Jammu & Kashmir.

- However, at a national or industry-wide level, corporate sentiment remains stable unless there is a full-scale war or international sanctions.

- Sanctions/Export Controls with Long-Term Effects

- India has taken a clear and rigid stance on not engaging in trade or negotiations with Pakistan until tangible action is taken against terrorism.Long-term export restrictions on Pakistan-aligned firms are possible.

- Companies may avoid any linkages with Pakistan.

- Policy or Regulation Changes

- India has already invoked a No-Tolerance Policy and suspended treaties (e.g., Indus Water Treaty).

- This hardline stance limits any policy-level economic re-engagement, and businesses must operate under increased uncertainty and regulatory risk.

- Capital Flow Redirection FDI changes, manufacturing exits or inflows

- Direct FDI or corporate investments between the two countries are minimal, so the disruption is negligible.

- However, if the situation escalates, global investors may reduce exposure to the region, particularly in infrastructure or sensitive sectors.

Summary

While the current impact remains sector-specific and regionally confined, the prolonged breakdown in diplomatic and trade relations could result in lasting strategic shifts, particularly in logistics, cross-border compliance, and risk-adjusted investment strategies. Hence, a score of 3 out of 5.

Net Evaluation

The India-Pakistan tensions currently score 3.17 out of 5 on the TDR Meter, reflecting a moderate but rising level of disruption risk. While immediate market impact has been contained, the situation remains fluid. A key concern is that if fears of escalation materialize, the geopolitical and economic consequences could become significantly more severe.

🔍 Possible escalation scenarios and their implications are discussed below.

Future Outcomes of India-Pakistan Tensions

- Diplomatic Measures: India may take diplomatic steps such as pressuring Pakistan through international forums and allied countries. Pakistan could be pushed toward sanctions or placed back on the FATF grey list, leading to disruptions in obtaining financial aid from institutions like the World Bank and the IMF. India could advocate for strict measures against the already economically weakened Pakistani state. However, implementing diplomatic sanctions won’t be easy due to Pakistan’s close ties with Turkey and China. Moreover, it is highly unlikely that India will rely solely on diplomatic measures.

- India Conducts a Controlled Strike:

India has previously carried out controlled strikes in 2016 and 2019, which did not escalate into full-scale war. However, whether India can execute another swift “go-in-and-out” attack this time remains uncertain, especially as Pakistan is already preparing for such a possibility.

- War with Pakistan:

A direct, one-on-one war with Pakistan appears highly unlikely given Pakistan’s current economic instability and its ongoing wait for an IMF bailout. Pakistan alone may not be able to sustain a military conflict with India.

- An All-Out War Involving Other Countries:

The worst-case scenario would be an all-out war involving Pakistan and its allies versus India and its allies. With two major wars already ongoing in the world, a third global conflict is highly unlikely. Most global powers would likely urge de-escalation to prevent further destabilization.

Out of all the 4 scenarios, the most likely outcome will be that India conducts a controlled strike with a ton of diplomatic measures. But one cannot be sure what a small fire can lead to.

What does this mean for businesses?

Businesses operating in regions affected by geopolitical tensions must be prepared for possible war-like scenarios. In the worst-case situation, India could find itself embroiled in an all-out war with enemies on multiple fronts—Pakistan to the west, China to the north, and Bangladesh to the east. Such a scenario could disrupt vital shipping routes, as these countries may attempt to cut off major trade routes to limit the supply of essential goods.

While the likelihood of this scenario remains slim, businesses on both sides of the conflict should avoid engaging with each other. The rising tensions in the region could escalate unexpectedly, leaving businesses stranded or vulnerable to sudden disruptions.

For more insights and analysis on such critical topics, subscribe to The Decoding Room!